It is 2024 and we are in the middle of a digital revolution where delivering TV advertisements is increasingly becoming more nuanced, precise, and targeted. For video content owners, publishers and advertisers across the spectrum, Dynamic Ad Insertion (DAI) is going to play a pivotal role in growing their ad business over the coming years.

DAI is the technology with which advertisers can deliver targeted TV advertisements to different viewers which are more relevant based on their demographic data, location, context, or preferences. This can be done in two ways – Server-Side Ad Insertion (SSAI) and Client-Side Ad Insertion (CSAI).

As part of our “Demystifying Addressable TV Advertising” initiative, we want to acquaint you with each part of the ecosystem so that you can understand how it works, what are some of the benefits and challenges, and, why it is important to get it right so that you can maximise your revenue and ad yield. In this 2-part blog series, we look at some of the fundamentals of SSAI.

What is SSAI?

Server-Side Ad Insertion (SSAI) is a dynamic technology used to deliver advertisements in online streaming by seamlessly integrating ad content into video content. Unlike Client-Side Ad Insertion, where ads are loaded by the user’s device, SSAI operates on the server-side, thus creating a smooth experience by merging ads directly into the video stream.

SSAI facilitates precise targeting and personalisation of ads based on user data, providing advertisers with enhanced audience engagement. Moreover, it bypasses ad blockers, ensuring a more reliable delivery of ads and revenue generation for content providers.

How does SSAI work?

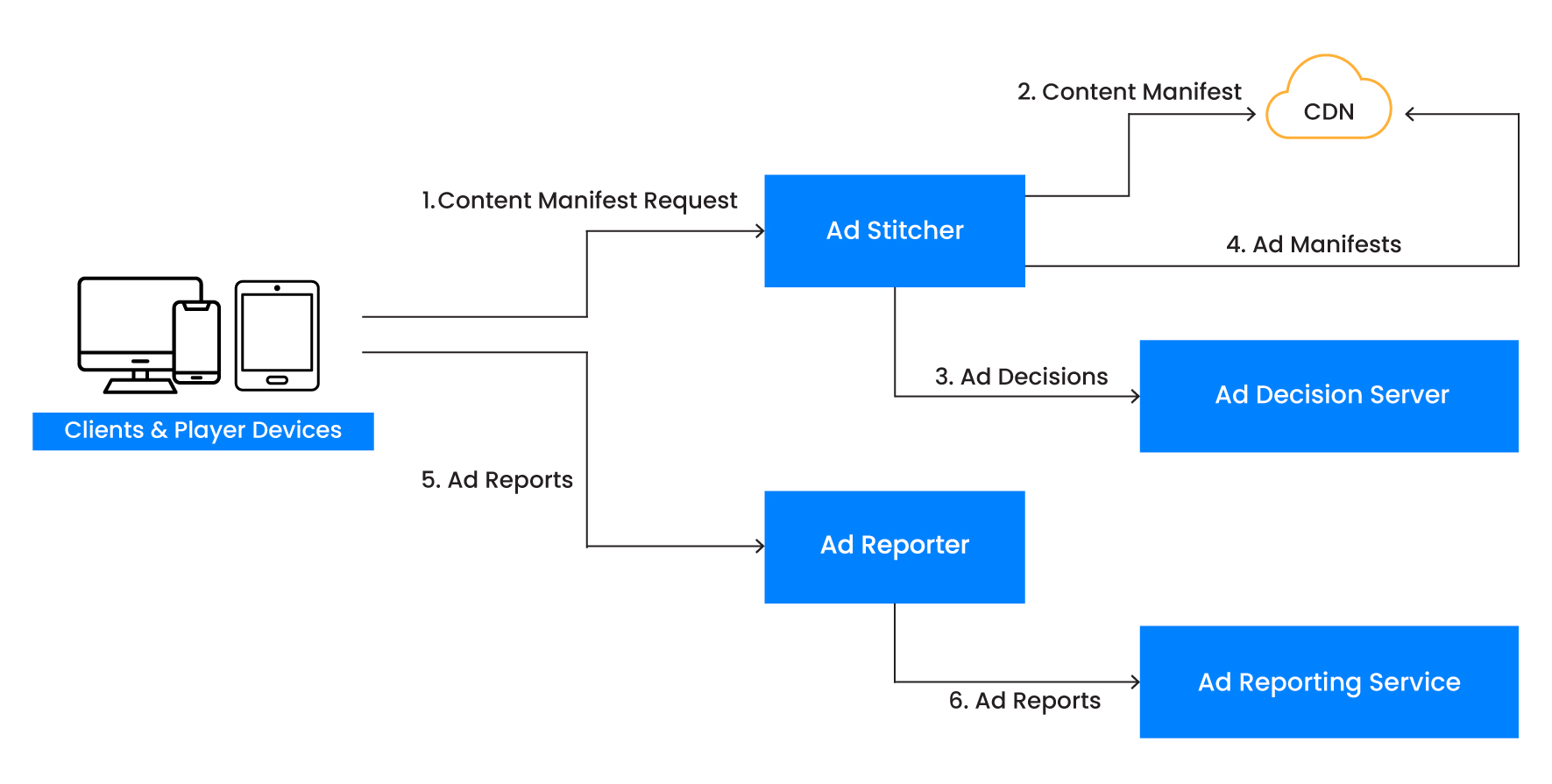

In OTT streaming, Server-Side Ad Insertion ensures seamless targeted ad delivery. Please refer to the diagram below for a visual guide.

When a client requests video (1), it contacts the Ad Stitcher with details like the video URL and user-specific targeting parameters. The Ad Stitcher fetches the original video’s content manifest file (2) and queries the Ad Decision Server to pick relevant ads (3).

These selected ads are formatted if needed and the Ad Manifest is inserted into the video’s original manifest file (4). The updated manifest file, which contains information about where the client can fetch content, then directs the client to get the creative from the CDN during a timed break in the programming. As the viewer watches the video, data is sent to an Ad Reporter by the client library (5) and then to an Ad Reporting Service to capture the ad impression and subsequent viewership (6). This basic approach works for both HLS and DASH content and can be applied to Live, Video-on-Demand (VoD), and TSTV services.

Why would I use SSAI?

Since the content and ads are stitched in the cloud, the viewing experience is seamless, with no black screens, latency, or buffering. Such interruptions or impairments to the viewing experience can lead to lower engagement or even content abandonment.

Moreover, when compared to client-side solutions, SSAI requires less integration and development time since there is very little required of the client. In the long run it will be easier to maintain as well, considering how the types of streaming devices and players continues to proliferate.

How can I learn more about Synamedia Iris and SSAI?

SSAI is an important part of the Synamedia Iris solution, which is designed to bring different devices, networks, services, and monetisation models into a single, unified ad management, decisioning, and delivery platform.

Understanding SSAI fundamentals empowers content owners, publishers, and advertisers to optimise ad delivery across devices and networks. To delve deeper into SSAI and Synamedia Iris, read ‘Going beyond the fundamentals of SSAI’ and watch the on-demand webinar. You can share your insights here.

About the Author

Tzvi Gerstl is responsible for R&D for products, services, and technologies across Synamedia’s Media Cloud Services and Broadcast Technology Businesses. A member of the Synamedia Executive Leadership Team, Tzvi is also leads enterprise IT, business applications, and operational and product security.

With 20 years of experience in the video industry, Tzvi is a dynamic and energetic leader with extensive knowledge of technology and experience in running large-scale development programmes for innovative market-leading solutions.

Tzvi holds a PhD in Scheduling Algorithms, has authored more than 25 papers on algorithms in high-ranked journals and is the holder of several patents. He is a Dean Fellow at the Business School of the Hebrew University of Jerusalem. In his free time, Tzvi enjoys running and reading.